Workforces have been afflicted with innumerable obstacles as a result of 2020 that carried a pandemic, and social unrest, resulting in a shift in how people interact with companies and how in retrospect, teams interact with each other. Organizations are increasingly leveraging remote work and automation, leaving stakeholders in desperate need of support to learn how to navigate these waters.

Deloitte shared three key takeaways leaders must take into account to help their teams adjust to the new teams effectively.

- Focus on agility and flexibility.

- Be bold and willing to try new things.

- Acquire the necessary digital capabilities.

Stemming from these three requirements, Telefonica, one of the largest telecommunications companies in the world, succeeded in reducing an existing breach between IT and business-related teams by automating data actionability by more than 100%.

Data Actionability Challenge

Data analysis teams are tackling challenges most companies in 2021 are also facing. Trying to reduce the existing siloes between IT and business-related teams, Some of those obstacles skim around:

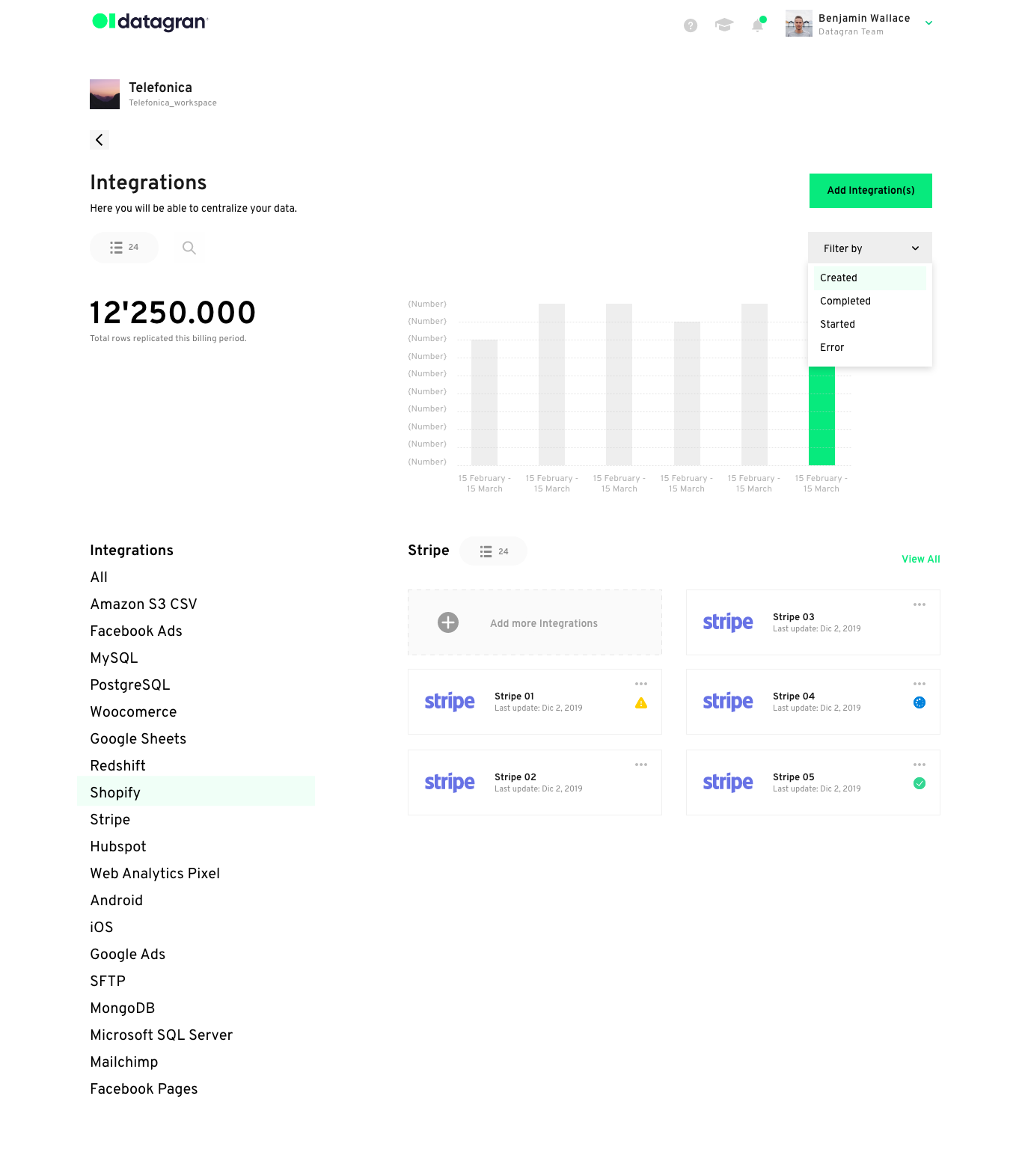

- Integrating data coming from different sources.

- Standardizing and communicating data value in its simplest form so everyone knows what they are looking at.

Use Case: Migrating Thousands of Users Payments to a Digital Platform

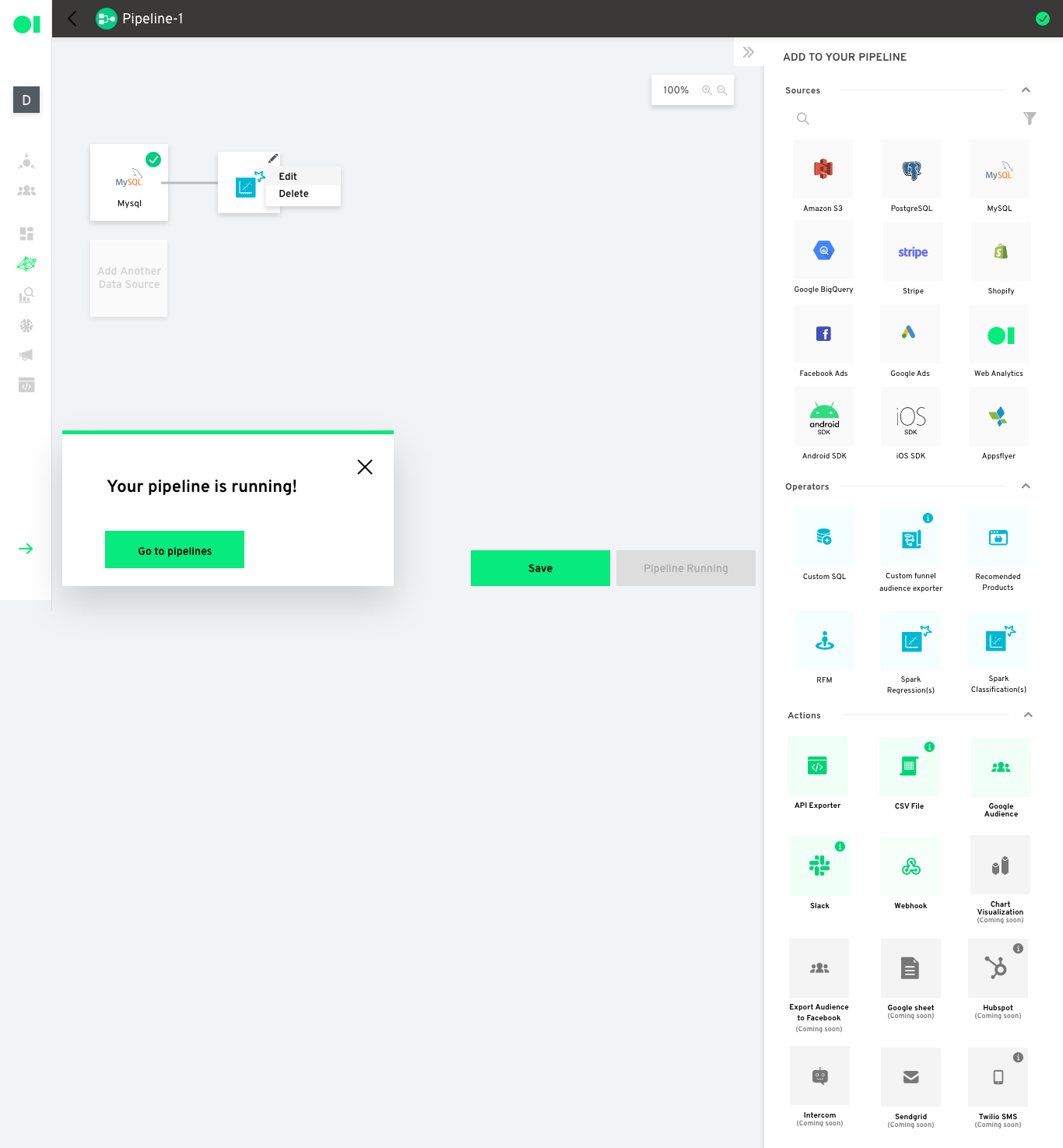

Finding value in data can be approached in a number of ways. Telefonica identified information that could generate a shift in their users’ payments processes, so their in-house team could make decisions focused on reducing third-party expenses. The goal was to build an automated machine learning model that could receive data from multiple sources, process the data in order to consolidate it appropriately, apply clustering algorithms to segment users and send the outcome so all of the involved business units could read it, analyze it and act on it appropriately. Telefonica intended to predict if users could be migrated from one payment system to another, and with the help of the initial data centralization process and ML models, they hoped to run ML models that could predict certain behaviors. Then, the goal was to use that outcome to send it to a communication app to reach those customers in a more personalized manner.

Prior to identifying the potential in making such a significant shift, their team needed to ask questions and draw hypotheses that would help them guide the process.

- What opportunities arise from migrating offline payments to online payments based on current user behavior?

- What is the general diagnosis from our users’ payment behavior based on their payment dates and invoice amounts?

- What areas around the country show a higher opportunity for migration?

- Which communications insights can be made actionable in order to induce change in payment habits?

Data Centralization

The process was initiated by integrating Telefonica’s data which was stored in several sources, into Datagran. Once integrated, the data was cleaned and standardized so they could have it available to use in this model and future ones.

This was critical to them because it solved an efficiency challenge: Save valuable time centralizing data so it could be used in machine learning models anytime.

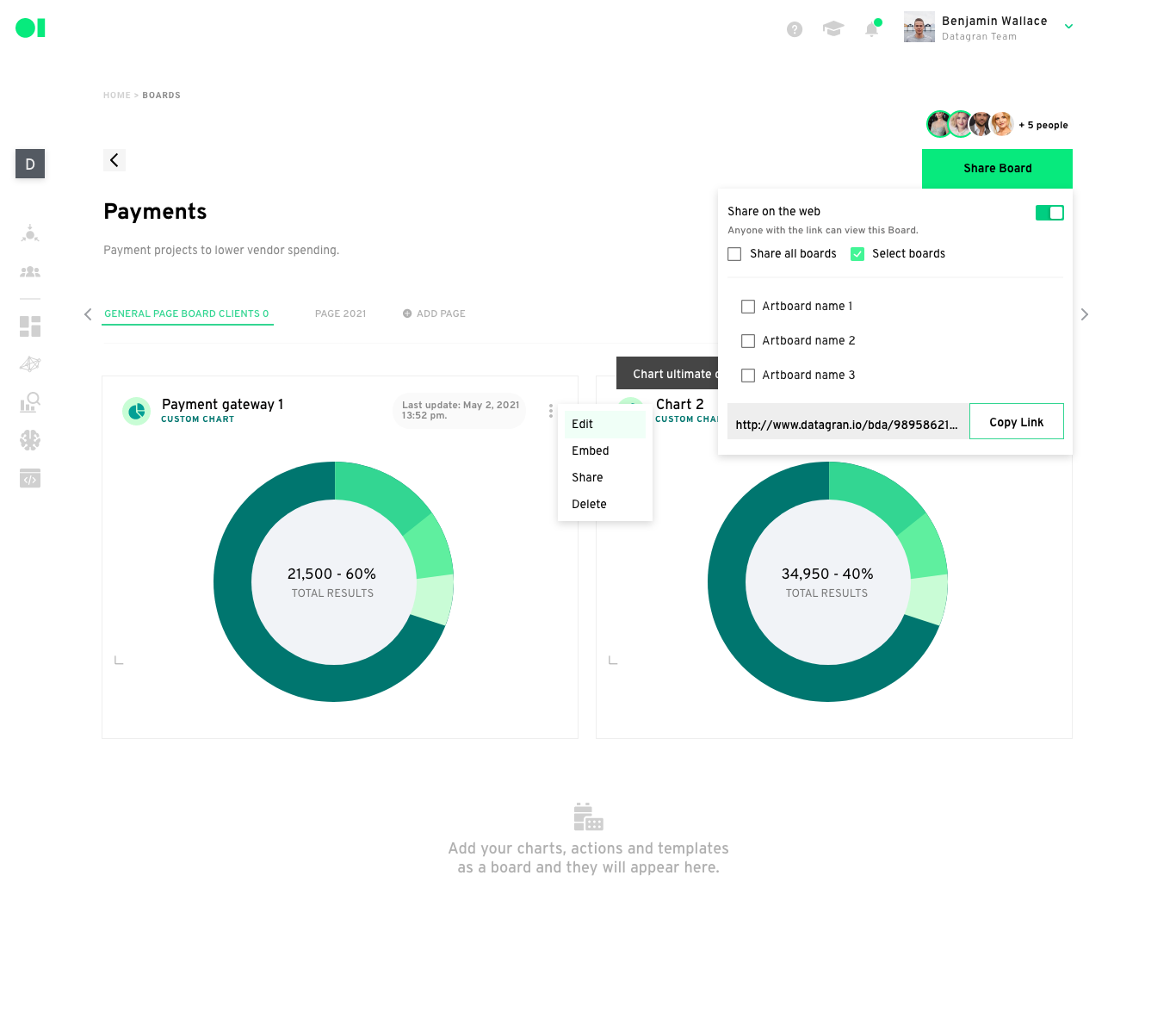

Data Visualization

The next step was to transform the integrated information into flexible visualization systems like graphs with real-time data made available to all teams throughout the organization, with business statistics and end-to-end customer behavior that could show customer path from attribution to login at the payment gateway’s website.

Machine Learning Models

Thanks to Telefonica’s experienced data team, they were able to correlate the amounts paid on invoices with their specific times and dates. Third-party payment gateway data for online and offline transactions were also identified. Lastly, they could find the preferred payment gateway among their customers. And, derived from behavioral insights, the team could run predictions with machine learning models with pipelines.

“The challenges faced from migrating offline to online payments are tied to shifting mindsets on the adoption of new technologies, incorporating efficient systems for emitters, acquirers, businesses, and users. Implementing strategies that were aligned within the financial system, making sure there is interoperability and a clear understanding of its use benefits”

Portafolio Magazine. 2019

After achieving their goal by more than 100%, Datagran provided the tools to not only introduce a new way of work through data-driven decisions by automating machine learning algorithms, but it allowed their team to migrate more than 14,000 users to an online payment solution that reduced third-party costs and it introduces a new collaborative model for their teams and all areas within the organization.

.jpg)